Calculate adjusted basis of rental property

The IRAS property tax payable is calculated with this formula. Leave it to the rental company.

Is Rental Property A Capital Asset And How To Report It Taxhub

Both investors and regular homeowners alike often see great benefits from using a rental company to rent their property.

. The most common cause of NOL is the loss incurred while operating the business. As a progressive tax scheme which can be perceived as a form of wealth tax the adjusted property tax will be more significant for those who. The Internal Revenue Service IRS calls this type of property like vehicles machinery equipment and furniture capital assets.

But basis can also increase or decrease during the time you own the property. Here are the steps to follow to calculate the depreciation for the rental property for the first full year of ownership. Generally gain loss on sales or other dispositions of property is computed by subtracting the adjusted basis of a property from the value of cash and property realized on its sale or disposition.

On Tuesday September 6th 2022 the average APR on a 30-year fixed-rate mortgage rose 1 basis point to 5990The average APR on a 15-year fixed-rate mortgage rose 1 basis point to 5250 and the. The reason is that when property changes hands as a result of a divorcewhether it is the family home a portfolio of stocks or other assetsthe tax basis of the property also changes hands. The original basis is your purchase price or 340000 in this case.

The losses can be carried back two years prior to the NOL year or carried forward for 20 years. Calculate the purchase price or basis of your rental property. Tax taken off any income in box 20 0 0.

According to Spellings a rental company can become a wall between you and the occupants. When your business buys property for long-term use you can take deductions for the cost of the property by spreading it over several years using a process called depreciation. These taxes must be paid before 31st January on a yearly basis.

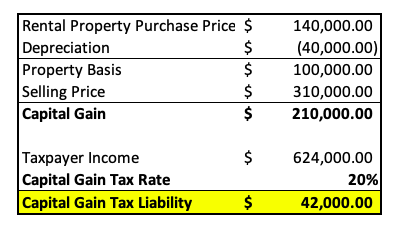

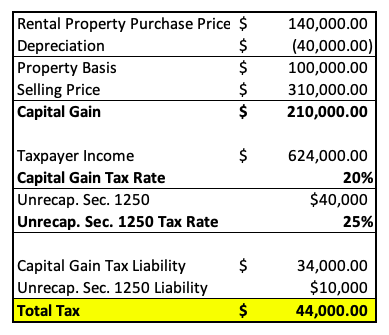

Subtract the adjusted basis from the sales price to determine what gains will be taxed under the current capital gains tax rate. Updated March 2021. The investors realized gain.

Property income allowance read the notes 0 0. Your total gain is simply your sale price. Because the new owner gets the old owners basis he or she is responsible for the tax on all the appreciation before as well as after the transfer.

How to Calculate Property Tax in Singapore. It takes that emotion out of. 550000 the sale price minus.

135000 20000 155000 adjusted cost basis. 06232021 06162019 by Ben Mizes. Rates listed in the Rental Rate Blue Book are intended as a guide to determine the amount an equipment owner should charge in order to recover equipment-related ownership and operating costs.

Now we can finally calculate our gains. Our publications and personalized correspondence are available in braille large print e-text or MP3 for those who have a visual impairmentFor more information go to Order alternate formats for persons with disabilites or call 1-800-959-8281. Understanding a rental companys role.

When a rental property is sold the adjusted cost basis is used to calculate the profit on the sale and the capital gains tax liability. If you purchase a like-kind property for 250000 your basis in that second property will immediately be 300000 your adjusted basis in the first property. How to Calculate Depreciation Recapture on Rental Property.

Resources Data and Analysis for California Originally published July 2014. Seniors like other property owners pay capital gains tax on the sale of real estate. To find the bottom line for a house with a 116450 adjusted basis and a 164115 amount realized subtract the former from the latter to find a total gain of 47665.

As specified for residential rental property Eileen must use the straight line method of depreciation over the GDS or ADS recovery period. Because Eileens adjusted basis is less than the fair market value on the date of the change Eileen uses 39000 as her basis for depreciation. Adjusted basis Basis Commuting Disposition Fair market value Intangible property Listed property Placed in service Tangible property Term interest Useful life You can depreciate most types of tangible property ex-cept land such as buildings machinery vehicles furni-ture and equipment.

Premiums for the grant of a lease from box E on the working sheet 0 0. Add cost of the roof to the property cost basis. The tax treatment of the gain depends on how long you held the asset short-term capital gains taxes apply to homes held for less than one year and long-term gains apply if.

If youve used traditional accounting rather than cash basis to calculate your income and expenses put X in the box. She chooses the GDS recovery period of 275 years. These rates are derived.

That means the propertys adjusted cost basis is 200000 the purchase price minus the total depreciation taken. Under the Affordable Care Act eligibility for income-based Medicaid 1 and subsidized health insurance through the Marketplaces is calculated using a households Modified Adjusted Gross Income MAGI. After some time the investor sells the duplex for 750000.

Some adjustments can increase your basis in an asset while others can reduce it and the latter generally is not a good thing at tax timeYou can increase your basis from there by adding the. If you are outside Canada and the United States call 613-940-8495We only accept collect calls made through. You can also depreciate certain in-.

Some other problems that might contribute to NOL include property damages natural disasters business expenses theft moving costs and rental property expenses. The higher your basis the less youll pay in capital gains tax when you sell. Here are some of the most common ways to adjust the basis of your rental property.

Calculating your adjusted basis in an asset begins with its original purchase price. Introduction to Cost Recovery Rental Rate Blue Book. Special tax provisions however apply with respect to the calculation of gain on property acquired before June 1 1971.

The original basis is the price you paid for the investment property plus any improvement. The gain is the difference between the adjusted basis and the sale price. 4000 kitchen appliances 5.

The Rental Rate Blue Book is a comprehensive guide to cost recovery for construction equipment. A 250000 house with a. Part of the Labor Centers Covid-19 Series.

To illustrate assume that our investor holds the single-family rental home for 5 years before selling for a net sales price of 165430 after deducting seller closing costs and the real estate commission. Increasing the basis of your rental property reduces the amount of taxable.

How To Report The Sale Of A U S Rental Property Madan Ca

A History Of Home Prices In North America House Prices Real Estate Pictures Financial Advice

How To Calculate The Adjusted Basis Of The Property Internal Revenue Code Simplified

The Only Rental Property Calculator You Ll Ever Need Fortunebuilders In 2020 Rental Rental Property Capitalization Rate

The Beginner S Guide To Buying Rental Properties A Case Study Retipster

Rental Income And Expense Worksheet Propertymanagement Com

Rental Property Cost Basis Calculations Youtube

How To Calculate Rental Income The Right Way Smartmove

Rental Property Profit Calculator Watch Quick Video Mortgageblog Com

Second Home Vs Investment Property What S The Difference

Rental Property Depreciation Rules Schedule Recapture

Is Rental Property A Capital Asset And How To Report It Taxhub

How To Use Rental Property Depreciation To Your Advantage

How To Report The Sale Of A U S Rental Property Madan Ca

How To Calculate Adjusted Basis Of Rental Property

Converting A Residence To Rental Property

How To Report The Sale Of A U S Rental Property Madan Ca